Whether the markets are reaching all-time highs or crashing down, this is the crypto passive income strategy to making money in either market. This money making guide is geared towards long term investments in the United States.

Disclosure: This is not financial advice – these are my opinions alone. All investment strategies and investments involve risk of loss. Nothing contained in my emails should be construed as investment advice. There is no guaranteed specific outcome or profit.

With that out of the way…

The information here on how to earn passive income in crypto assumes you already have basic knowledge of cryptocurrencies and blockchains. If you are into learning via the trial by fire method, transferring, buying, selling, and exchanging amounts of $5 or less is recommended until you feel confident you aren’t sending your money to the wrong place.

This is anecdotal information based on what I’ve researched, found, and trialed for a crypto passive income.

Table of Contents

Tax Implications with Cryptocurrency

Tax law is really annoying in the United States for crypto. Compared to the stock market, it is easy to create your own inefficiencies and extra tax events without realizing what you’re doing. Laws and regulations are still being created in this very new way to make money and invest.

Strategies discussed try to account for tax law and events and adjust accordingly. Some of the cryptocurrency exchanges and entities make fling taxes easier, some don’t offer much help and it can be real hassle to keep track of everything you’re doing. I try to avoid those hassles.

Official IRS promoted page regarding virtual currencies: https://www.irs.gov/businesses/small-businesses-self-employed/virtual-currencies

A couple key takeaways to consider as you setup your passive income strategy with crypto:

Q–1: How is virtual currency treated for federal tax purposes?

A–1: For federal tax purposes, virtual currency is treated as property. General tax principles applicable to property transactions apply to transactions using virtual currency.

Q–6: Does a taxpayer have gain or loss upon an exchange of virtual currency for other property?

A–6: Yes. If the fair market value of property received in exchange for virtual currency exceeds the taxpayer’s adjusted basis of the virtual currency, the taxpayer has taxable gain. The taxpayer has a loss if the fair market value of the property received is less than the adjusted basis of the virtual currency. See Publication 544, Sales and Other Dispositions of Assets, for information about the tax treatment of sales and exchanges, such as whether a loss is deductible.

Sign Up Bonuses

When registering for accounts on different cryptocurrency exchanges, I’ve found there are almost always extra bonuses for using referral links. I’ve included links of my own for each exchange mentioned, or you can reach out to a friend and use theirs. Both parties are generally rewarded.

Extra bonuses are anywhere from $5 to $500 worth of Bitcoin and all sorts of coins in between.

Depending on how many crypto sites you sign up for, you can easily get an extra couple hundred dollars worth of Bitcoin or more.

The Best Methods for Passive Income with Crypto

There are several really creative ways to earn crypto passive income – choosing one depends on your current working capital, or how much money you’re willing to invest, how confident you are in a certain coin or token or platform, and your time in market. I’ve found working capital to be the most important to make the most with passive income. Well, that and using a reputable service.

Proof-of-Stake (PoS) Staking

Proof-of-stake is a type of blockchain consensus mechanism designed to allow distributed network participants to reach an agreement on new data entering the blockchain. Blockchains enable open and decentralized networks where participants contribute to governance and processes involved in validating transactions. This is critical because a community-focused approach eliminates the need for central authorities such as banks. Most of the time, blockchains randomly pick participants, elevate them to the status of validators and reward them for their efforts.

Requirements used to select validators vary on each blockchain. Blockchain networks require users to deposit or commit their financial resources to the network. Here, the blockchain selects validators from a pool of users that have staked a specified sum of its native digital asset. In return, validators earn interest on the staked funds for contributing to the validity of the network. This validation mechanism is what is called proof-of-stake. It provides an opportunity for holders to generate passive income.

When choosing blockchains to gain passive income from, you could prioritize PoS blockchains that allow you to delegate your stakes to other participants who are ready to take up the technical requirements of staking. The reward distributed to validators is slightly higher than that of a delegator. Some of the more popular PoS blockchains are:

- Cardano

- Ethereum 2.0

- Polkadot

- Solana

Each has their own staking requirements. For example, you normally have to deposit a minimum of 32 ETH on the Ethereum 2.0 blockchain to become a validator.

With a third-party staking service, however, you could deposit as little as 5 ETH to start accruing interest, although I haven’t dived that deep yet. Generally, these services help you stake without managing infrastructure of specific requirements for each blockchain. A quick peruse seems to indicate around 3% – 10% APR interest as of January 2022 for using a third party service.

Interest-bearing Digital Asset Accounts

If you are investing in a specific coin for the long term, this is by far the easiest strategy to incorporate. This is essentially like putting your money into a traditional high yield savings account at a bank. The only difference is you are earning interest on crypto, which is dispensed daily, weekly, or monthly depending on the company.

As of January 2022, based on tax laws, interest cannot be compounded automatically. You have to re-invest it yourself into either the same cryptocurrency or something new.

Crypto service providers offering interest:

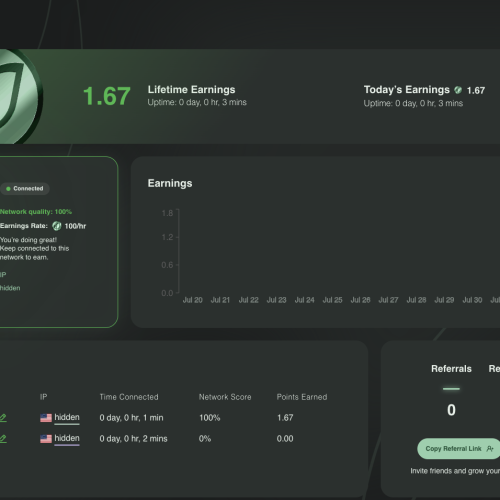

Crypto.com [ https://crypto.com/app/u3s52xrm52 offer code u3s52xrm52] is my primary contender. Up to 12% interest on staking USDC. You can also get 10% interest on Crypto’s own coin, CRO. Interest can be collected daily, although different calculations put a sweet spot at once every 1-2 weeks, which reduces tax events from 365 to 52. Yeah, hitting the button on their app to collect interest and reinvest [essentially a manual drip like dividend] creates a tax event for the IRS.

They also have a ton of other coins/tokens you can receive interest on if you are buying for investment purposes and get interest as well.

The catch: To get the most interest, you need to have $40,000 worth of the crypto.com stakes and have their VISA card, which enables much higher interest. $4000 is a lower tier option, potentially still worth it at around 8% – I think. I’m sure you can guess which option I’m going for based on our interactions today!

This is by far the least risky and highest reward interest farming available.

Binance.us [ https://accounts.binance.us/en/register?ref=53213551 ] is the largest crypto exchange in the world and this is their US version, which allows for staking of random coins and tokens. Interest varies from 1-6.5% depending on length of the term and the coin. Not a high priority for me, but decent if I am interested in a specific coin they are currently offering interest on. Programs vary and change, so its worth keeping an eye on depending on your investment risk tolerance.

Coinbase [ https://www.coinbase.com/join/kahn_3m ] is similar to Binance in that it has a lot of different coins and tokens available to earn interest on. Their USDC only offers 0.15% APY though. Currently they offer a few others between 2-5% interest yield.

For the sake of collecting interest on sitting cash, crypto.com currently remains the best contender. There are specific strategies to lowering fees/costs of making this happen that I’m still exploring and researching. A big challenge is the laws and rewards change based on country, and when reading things on the internet, often times people make no mention of whether or not they are in the US or elsewhere.

The Ladder Strategy

When staking in either a stablecoin or cryptocurrency coin, or some other asset, one of the best strategies to utilize is called Laddering. Let’s take for example a 3 month term for Crypto.com’s USDC coin at 12% interest. You are locking up your money for 3 months. However, if you are wanting to reduce lockup periods and increase liquidity, you can ladder your staking.

Take your goal or initial amount you will stake. Divide that by 12. Or, if you’re super organized, divide by 52. Pick one day a week and stake that divided amount for 3 months. Continue to roll it over and restake each week.

For example, if you have $10,000 in your emergency fund but want to earn 12% interest, stake $833 each week over 12 weeks. At week 13, you will restake $932, which is the 12% interest. Or, you can pull out the extra interest earned and place it somewhere else.

European Markets for Crypto

If you are outside of the United States, one of the best exchanges out there is Binance. They have a ton of automated staking programs in all sorts of coins. I have a few friends who have signed up through them and have been happy with the results.

Risks of Crypto Passive Income

Some of these strategies to earn passive income through crypto seem too good to be true. So what’s the catch?

- Value of coin goes down. For coins that aren’t 1:1 to the US dollar, there is a risk of the value decreasing from your purchase price.

- Rug pull. There is a chance you find yourself trying out a DeFi app or other third party service which takes your money and runs.

- Company goes under and disappears. These companies do not have traditional FDIC insurance – if they go under, there is a chance it will happen before you are able to withdraw your funds.

- Hacking. Whether your account is hacked or the company as a whole, Cryptocurrency puts a lot of responsibility on you as the end user. 2FA and text messages can be hijacked for verification. Phishing scams are rampant. You really need to be incredibly careful and cautious as you use any of the cryptocurrency platforms. I’ve found convenience breeds opportunity. Don’t feel like 2FA? Want a lazy password? You’re setting yourself up for massive heartbreak.

Further reading:

- Buy Bitcoin on Paybis

- https://www.coindesk.com/learn/what-is-yield-farming-the-rocket-fuel-of-defi-explained/

- https://coinmarketcap.com/yield-farming/

- https://www.coinbase.com/learn/crypto-basics/what-is-staking

- https://www.nerdwallet.com/article/investing/how-crypto-staking-works

- About the Author

- Latest Posts

I strive to paint vivid landscapes with my words, bringing the magic of far-off lands and enchanting aromas to life for my readers. Combine passion for exploration and the art of gastronomy in an unending ode to the senses. When I’m not traversing the globe, I find solace in the earth beneath my fingertips, tending to my garden and working on projects around my verdant oasis. MK Library serves as a beacon, guiding fellow travelers and homebodies alike to embrace sustainability, nurturing both our planet and our souls with purpose. Full Bio.