Ever wondered how the world of finance has evolved with technology? Well, technology is reshaping everything, including how we manage our wealth.

Wealth management solutions are no longer confined to the rich and famous; thanks to tech, they’re now accessible to everyone. In this article, we’ll explore the incredible impact technology has on wealth management, from making it easier to track investments to offering personalized financial advice.

Get ready to see how technology is making smart financial management a possibility for all.

Table of Contents

Data Aggregation and Analysis

Data collection is one of the cool things that tech can do. It’s putting all of your banking data in one place.

After that comes research. It’s like having a very smart friend look over your finances and give you tips on how to make better choices.

Robo-Advisors and Artificial Intelligence (AI)

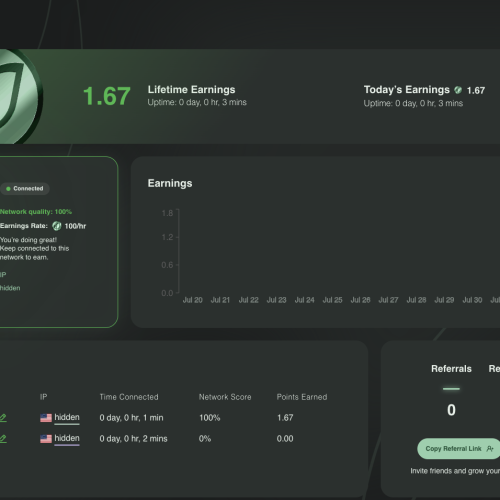

Robo-advisors are like having a financial advisor who never sleeps. They use AI to manage your investments based on your goals and risk tolerance.

AI doesn’t just manage your money; it’s also great at answering your financial questions. It’s always there to help, any time of the day.

AI for financial advisors is also transforming the industry by providing them with advanced tools to analyze market trends, optimize portfolios, and deliver more personalized advice to their clients.

Another way technology helps is by making investing easier for everyone. You don’t need a lot of money to start investing when you use these tech tools.

And finally, technology keeps your money safer. It uses strong encryption to protect your financial information, giving you peace of mind.

Blockchain and Cryptocurrencies

The blockchain is changing the way we think about how to keep our money safe. It gives a group of computers their own log that records all events.

Cryptocurrencies like Bitcoin and Ethereum use blockchain to make it safe and easy for people to send money to each other. More and more people are investing in these digital currencies, which gives people even more ways to handle their money.

Keeping abreast with the growing interest in cryptocurrencies is essential. Hence, having a reliable resource like Blockfresh offers a comprehensive supply of the latest news on crypto and blockchain technology. This aligns well with how blockchain and technologies are transforming wealth management.

Client Engagement and Communication

Technology not only makes it easier to manage our money, but it also makes it better to talk to our financial advisors. Thanks to chatbots and private message apps, you can get answers to your questions right away.

In addition, these tools make it possible for conversation to be tailored to each person. They learn from your contacts with them, so the financial information and help you get are specific to your needs.

Lastly, retirement plans and investment strategies can now be easily accessed and monitored through mobile apps, making it convenient to stay on top of your finances. With these, you can start comparing 401k and 403b retirement plans to determine the best fit for your financial goals and circumstances.

Navigate Prosperity’s Path With Cutting-Edge Wealth Management Solutions

In the end, the key to navigating the complex world of finance lies in leveraging the right wealth management solutions. Technology has opened up new pathways, making it easier to access, understand, and manage your finances.

Whether you’re a rookie investor or a seasoned financial advisor, the innovative tools and platforms available today can guide you toward achieving your financial goals. Remember, in the vast ocean of finance, technology is your compass, leading you to prosperity.

We hope you enjoyed reading this article. If you found it helpful, be sure to check out our blog for more informative resources.

- About the Author

- Latest Posts

Whether she is researching the latest trends in home decor, life-changing destination getaways, or the best way to maintain your finances, Dewey takes pride in leaving no stone unturned. She is passionate about distilling and delivering high-quality information that you can use to upgrade your life.